Introduction

Part I – Carbon is King

Summary of Part II — The Entropy of Carbon

Welcome to this summary of Part II of the Silver Gun Hypothesis. In Part I we considered that all life is carbon-based, and that living organisms dissipate energy for homeostasis. These ideas were highlighted to prepare us for Part II, which presents a unified theory for the economics of carbon. For background information on climate change economics and entropy, see the YouTube videos at the end of this article. The complete working paper for Part II is about 90 pages, and so you may prefer to read this summary before attempting to read the working paper, which is available at this webpage:

The Silver Gun Hypothesis may be understood in terms of the following:

- Anthropgenic climate change is a systemic risk to civilization and ecosystems, and this risk is linked to economic paradoxes that are unresolved using classical methods.

- Most economists regard carbon taxation and cap-and-trade to be the primary policy options for correcting the market failure in carbon despite substantial evidence that these policies are politically vulnerable and do not provide a holistic solution to the climate crisis. Missing is a global response to dynamic climate tipping points and a need to scale-up Carbon Dioxide Removal (CDR), regenerate ecosystems, prevent species extinctions, and to address social inequity and inequality.

- A solution to the economic paradoxes of climate change is discovered to be a policy that is the ‘mirror image’ of the carbon tax. The new policy is called a Global Carbon Reward, and it is designed to finance carbon abatement and sequestration for a safe climate, and to incentivise ecological regeneration and social co-benefits.

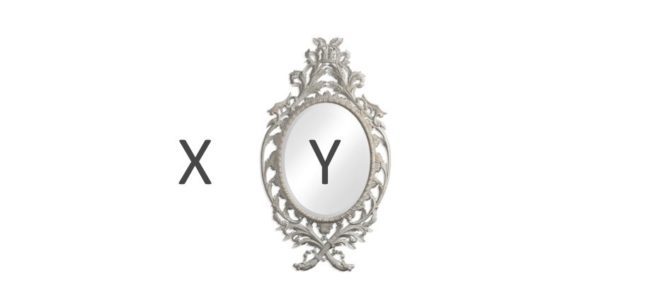

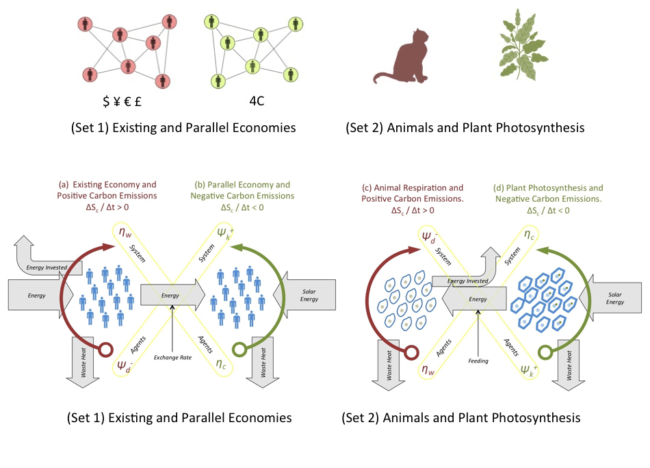

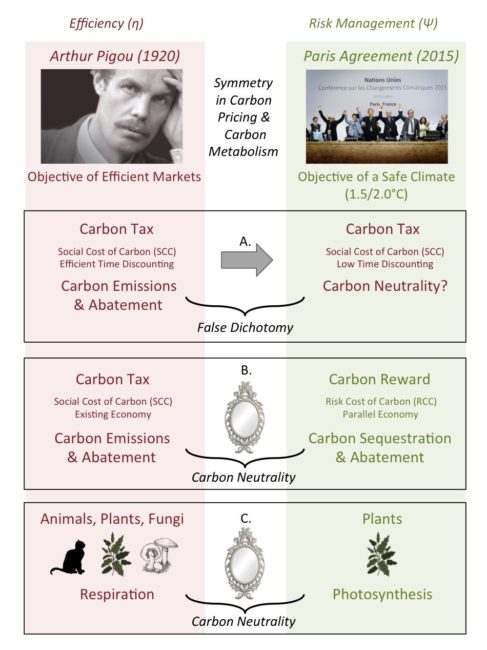

Part II of the Silver Gun Hypothesis includes a new theory for naturally occurring multi-agent systems. This theory is used to explain the utility of the Global Carbon Reward and the carbon tax from a natural science perspective. The theory suggests that the existing economy has an inherently low chance of achieving carbon neutrality because of its biophysical structure. The theory also suggests that a Global Carbon Reward is structured to mitigate carbon emissions and is needed to achieve a safe climate.If we symbolize the Global Carbon Reward as ‘Y’ and the carbon tax as ‘X’, as shown in Figure S2-1, then the ‘mirror’ is as a metaphor for an epistemology of complementary-and-opposite relationships. This mirror is used to ensure that Y has opposite features to X, while also ensuring that X and Y are complementary. The concurrent application of carbon taxes and a Global Carbon Reward is termed symmetric carbon pricing. Chen, van der Beek and Cloud (2019) show that symmetric carbon pricing creates a tradeoff between (1) improving market efficiency with taxes, and (2) maintaining a safe climate with rewards. This economic tradeoff is a possible breakthrough in sustainability theory.

Solving Economic Paradoxes

The Global Carbon Reward is derived from the carbon tax using the epistemic ‘mirror’ (see Figure S2-1). The analysis produces a dual system of carbon pricing with scope to achieve two objectives: (1) economic efficiency and (2) climate safety. The new policy toolkit creates a new roadmap for implementing the Paris Climate Agreement (UNFCCC, 2015). This new roadmap takes into account energy allocations in the world economy, the quality and quantity of Gross World Product (GWP), ecosystem regeneration, and social co-benefits.

The working paper for Part II provides a description of the financial mechanism for the Global Carbon Reward (see Section II.1 and Appendix II-A in Part II), however the main focus of Part II is a new biophysical-statistical theory that explains why a Global Carbon Reward can resolve the climate crisis at a biophyiscal level. To understand why the Global Carbon Reward is important, it may be helpful to first consider the utility of a parallel currency. The parallel currency that is proposed is a kind of Central Bank Digital Currency (CBDC) and it is termed Complementary Currencies for Climate Change (4C).

There are two major advantages of using a parallel currency: (1) the parallel currency can be issued directly to project owners to provide scalable finance for climate mitigation and socio-ecological co-benefits; and (2) the currency’s exchange rate can be managed by a peak authority for central banks to ensure that sufficient resources are allocated to climate mitigation.

The utility of the policy for a Global Carbon Reward is verified in Part II in terms of its ability to resolve the following economic paradoxes that characterize the climate crisis:

1) Agency Paradox

2) Growth versus Degrowth Paradox

3) Efficiency Paradoxes

4) Time Discounting Paradoxes

5) Tragedy of the Horizon Paradoxes

6) Sustainable Development Paradox

The above paradoxes are the ‘invisible elephants in the room’ for most economists. These paradoxes have one thing in common: they are temporal paradoxes because they all relate to humanity’s ability or inability to influence the future. A major finding of Part II is that the Global Carbon Reward offers a deep solution to the above six paradoxes. This is no trivial matter, because the above paradoxes are often assumed to be intractible. An essential feature of the Silver Gun Hypothesis is that a solution to the above paradoxes becomes available when a parallel currency is introduced.

The second paradox—growth versus degrowth—is summarised here because it is the most well-known paradox. The growth versus degrowth paradox is the problem that rising Gross World Product (GWP) is unsustainable because it is driving higher energy consumption and rising carbon emissions—thus exceeding the carbon budgets of the Paris Agreement. Unregulated GWP growth is also driving planetary-scale ecological degradation and rapid species extinctions. The paradox is that reductions in GWP are unacceptable to politicians and central banks because degrowth will cause financial instability and political conflict.

The growth versus degrowth paradox is solved by introducing the parallel currency for financing climate mitigation projects and for incentivising socio-ecological co-benefts via a managed exchange rate. The parallel currency is managed through an exchange rate mechanism that falls under a new international mandate for central banks. This mandate will require central banks to transfer purchasing power from their national currencies to the parallel currency over time and in a coordinated fashion. The metric for defining the exchange rate target is the Risk Cost of Carbon (RCC).

A peak authority will manage the exchange rate mechanism to provide an orderly macro-economic transfer of energy and other resources from the existing economy to the parallel economy for climate mitigation. This will manage the quality and quantity of GWP with the final goal of maintaining a safe climate and avoiding planetery overshoot. This exchange rate mechanism is also a potential solution to the ‘no way out’ problem interpreted by Garret (2012), which refers to civilization’s current dependency on fossil energy.

A political advantage is that the cost of the policy does not register in any fiscal budgets because the costs are dispersed as currency trading and a thin inflation levy that is spread globally. This implies that no governments, no firms, and no citizens are required to directly fund the Global Carbon Reward. This monetary approach may be associated with an economic school of thought called Modern Monetary Theory (MMT), but the Global Carbon Reward is more sophisticated than standard MMT because it also includes a biophysical-statistical model for understanding human economies.

The Global Carbon Reward solves a problem that is often stated:

“Infinite growth is impossible on a finite planet”.

The Parallel Currency

A key finding of the Silver Gun Hypothesis is that a parallel currency is derivable as a policy tool through the epistemic ‘mirror’ (see Figure S2-2). When the carbon tax is translated from the left side of Figure S2-2 to the right side, the unit of measurement for carbon emissions (1000 kg of CO2e emissions) is taken from the social agreement for the carbon tax, and is reversed and then applied as the new unit of account for the carbon reward (100 kg of CO2e mitigation). This new unit of account invokes the parallel currency. The unit mass of CO2e for the parallel currency is reduced by one tenth (from 1000 kg to 100 kg of CO2e) to establish a more convenient exchange rate.

The parallel currency is pivotal because it invites an extension to Arthur Pigou’s (1920) classical theory on market externalities. Part II explains why there can exist a second type of externality—called a ‘systemic externality’—that is the result of the economic system itself and is not a fault of market actors. The systemic externality is the cost of overcoming the economy’s structure, which is a major driver of brown growth and associated carbon emissions. This structural problem is sometimes called the ‘carbon lock-in effect’. The parallel currency provides a channel through which the cost of overcoming the systemic externality can be priced into markets. The parallel currency also invites a new monetary policy that can disperse the cost of overcoming the systemic externality across the global economy. This cost disperal is achieved through currency trading in open markets, such that market actors are not directly taxed to fund the Global Carbon Reward.

In Section II.1 of the working paper for Part II, the market failure in carbon is reclassified as a ‘thermodynamic market failure’ because the systemic externality for carbon is created by a strong physical/chemical coupling between carbon and energy.

Symmetric Carbon Pricing

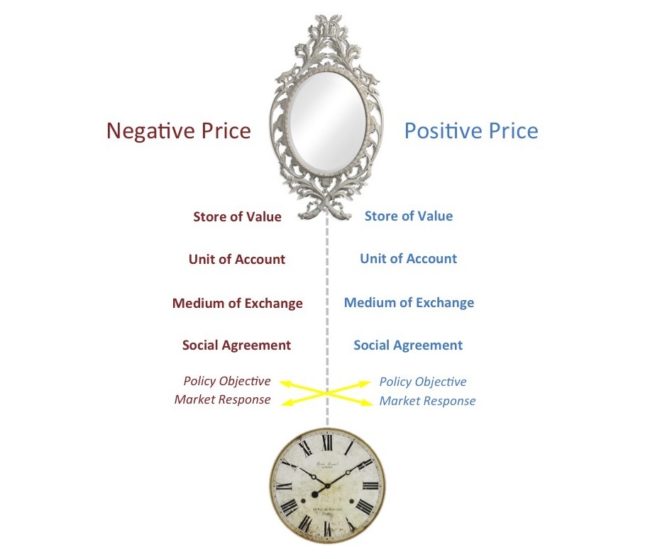

The policy for a Global Carbon Reward was derived from the carbon tax by assuming that social agreements should follow the ‘crossed arrows’ shown in Figure S2-2. The social agreements of the two policies produce a trade-off between: (1) market efficiency with taxes, and (2) climate safety with rewards. This offers a theoretical resolution to the six paradoxes mentioned above, and it suggests that the ‘crossed arrows’ are socially and biophysically important. Chen, van der Beek and Cloud (2019) explain this dual-policy relationship with their Holistic Market Hypothesis (HMH), however the HMH falls short of giving a detailed biophysical explanation for the ‘crossed arrows’ in Figure S2-2 even though the HMH refers to entropy as the cause. If the crossed arrows in Figure S2-2 are genuinely related to entropy and the ‘arrow of time’, then a biophysical explanation may be found. Part II of the Silver Gun Hypothesis presents a theory that the ‘crossed arrows’ are the result of a thermodynamic scaling effect that relates to all natural multi-agent systems.

New Multi-Agent System Theory

A major aim of Part II is to answer the following question: why does the Global Carbon Reward resolve the economic paradoxes of climate change? The hypothesis is that the Global Carbon Reward solves the above mentioned economic paradoxes because it creates a parallel economy that is symmetric to the existing economy in terms of its influence on the entropy of carbon and associated carbon fluxes. This symmetry has a policy context and a biophysical context. The policy context includes the asymmetry of social agreements, shown as the ‘crossed arrows’ in Figure S2-2. The biophysical context is explained in Part II with the probabilistic theory for multi-agent systems, as shown in Figure S2-3.

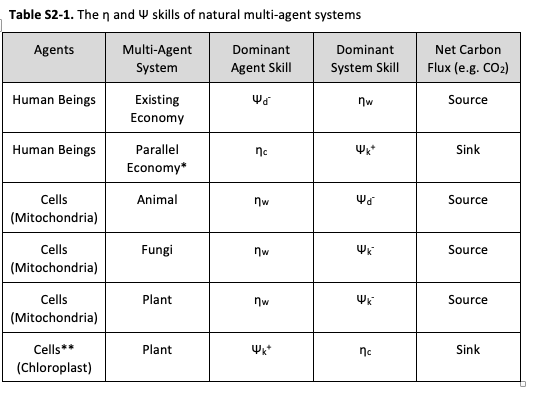

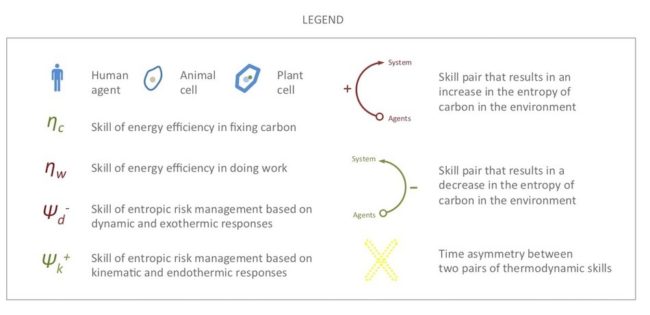

The multi-agent system theory is used to describe the existing economy with/without a carbon tax, and to describe the parallel economy which may be created by implementing the policy for a Global Carbon Reward. The multi-agent system theory involves two thermodynamic metrics: (1) energy efficiency as a performance metric (η); and (2) entropic risk management as a probability (Ψ). Two kinds of energy efficiency (η) are considered important. One kind of η is the ‘work efficiency’ of the system, which for the world economy is defined by its ‘productive efficiency’ or Gross World Product (GWP) divided by energy consumed (see Equation II-12 in Part II). The other kind of η is the ‘sequestration efficiency’, which is related to the change in entropy of carbon divided by the energy input (refer Equation II-13 in Part II). These definitions of η are generalised so that they can be applied to any multi-agent system.

Entropic risk management (Ψ) is defined as the ability of a system to maintain its carbon structure in a sufficiently ordered state that it can achieve homeostasis and survive (refer Equations II-14 to II-19 in Part II). This defintion of entropic risk management (Ψ) involves a second term, called the ‘entropy of carbon’ (Sc) (refer Section II.4 of Part II). The entropy of carbon in the environment (Sc) is a non-standard measure of entropy, and it refers to the disordering/ordering of carbon in the environment. By reinterpreting the 1.5/2.0°C ambition of the 2015 Paris Climate Agreement as the upper permissible value of Sc for climate safety, the ambition of the Paris Agreement is reinterpreted as the ambition of managing Sc. The ambition of the Paris Agreement therefore requires that a union of nations develop a new global skill of entropic risk management (Ψ) (refer Table S2-1). The Ψ and Sc terms are key to bringing the concept of entropy directly into the analysis and design of climate policies.

In Part II, four possible types of Ψ are derived in an 2×2 ontological matrix, called the “Thermodynamic skills matrix for natural multi-agent systems [Ψ, η]” (see Table II-5 in Part II). This matrix is the heart of the multi-agent system theory because it defines four possible types of Ψ based on the following two systemic options:

- increasing the entropy of carbon with exothermic reactions (e.g. emitting CO2), or

- decreasing the entropy of carbon with endothermic reactions (e.g. fixing CO2);

and

- using information kinematically, or

- using information dynamically.

A radical new idea is that natural multi-agent systems, including human economies, can only express one dominant pair of η and Ψ skills. The defining feature of the theory is that agents inherit one of the skills (i.e. η or Ψ), and the other skill emerges from the multi-agent system. It is this pairing of the η and Ψ skills that characterises each multi-agent system. A major consequence of the theory is that a multi-agent system can only achieve homeostasis through one of two possible mechanisms: (a) emitting carbon with exothermic reactions, or (b) sequestering carbon with endothermic reactions. Consequently no single multi-agent system can achieve carbon neutrality on its own (incl. the existing economy).

A major interpretation is that carbon neutrality will require that at least two multi-agent systems to operate concurrently to achieve carbon neutrality—with one system emitting carbon and the other system sequestering carbon. As shown in Table S2-1, plants can achieve carbon neutrality because they have evolved as a symbiosis of two systems: (1) cells with mitochondria for respiraton, and (2) cells with choloroplast for photosynthesis.

The η and Ψ skills of two multi-agent systems that can achieve carbon neutrality are always complementary-and-opposite. This situation is described as an asymmetry of skills that is like the ‘crossed arrows’ shown in Figure S2-2. The crossed arrows in Figure S2-2 are therefore explained in terms of the η and Ψ skills of the two economic systems that are co-joined to achieve carbon neutrality.

A major interpretation of the Silver Gun Hypothesis is that a

Global Carbon Reward is needed to achieve carbon neutrality and a safe climate.

Thermodynamic Scaling Effects

The Silver Gun Hypothesis is the intepretation that natural multi-agent systems express a dominant pair of thermodynamic ‘skills’, termed η and Ψ (see Figures S2-3 and S2-4 and Table S2-1 in this summary; see Table II-5 in Part II). These ‘skills’ are (1) energy efficiency as a percentage (η), and (2) entropic risk management as a probability (Ψ). The term ‘skill’ is adopted because η and Ψ are products of evolution. The theory is that a combination of η and Ψ naturally emerges in multi-agent systems because it greatly enhances the homeostasis and survivability of these systems. An important feature of the theory is a theoretical link between η and Ψ and the First and Second Laws of thermodynamics (refer Table II-5 in Part II).

In Section II.6.3 of the paper for Part II, plants and animals are assessed in terms of their η and Ψ skills, and this assessment is used to validate the skills matrix. The η and Ψ skills of multi-agent systems are therefore the metrics that describe the scaling effects or scaling rules that reveal similarities/differences between complex adaptive systems of different types and sizes (e.g. when comparing an individual animal with the global economy). The main results of the validation are summarised in Table S2-1 and Figure S2-4.

The thermodynamic scaling effects that are presented in Table S2-1 and Figure S2-4 are potentially very important because they describe multi-agent systems in terms of their metabolism and relationship to carbon for internal homeostasis. Figure S2-4 illustrates two situations in which carbon neutrality can be achieved by pairs of multi-agent systems—given that they have ‘time asymmetric’ skills. This ‘time asymmetry’ of skills exists when the pair of multi-agent systems have η and Ψ skills that are ‘swapped and reversed’ (see Figure S2-4). The Silver Gun Hypothesis is the theory that the time asymmetry of η and Ψ skills is the thermodynamic ‘scaling effect’ that explains why the Global Carbon Reward can achieve carbon neutrality, and why the Global Carbon Reward is a fundamental solution to the previously mentioned economic paradoxes. This thermodynamic scaling effect could be a critically important insight if humanity wishes to maintain a safe climate.

Footnotes:

- See Table II-5 in Part II for details.

- * denotes the economy created with the Global Carbon Reward

- ** denotes a quantum mechanical Ψ skill (not classical thermodynamic).

- ηw is energy efficiency in relation to doing useful work

- ηc is energy efficiency in relation to fixing carbon.

- Ψ is a skill of managing entropic risk with respect to carbon.

- Ψk denotes kinematic (k) use of information to build structures.

- Ψd denotes dynamic (d) use of information to take actions.

- Ψ– denotes exothermic (-) reactions to achieve homeostasis.

- Ψ+ denotes endothermic (+) reactions to achieve homeostasis.

- See image below

New Economic Paradigm

The Silver Gun Hypothesis is an inter-disciplinary theory at the nexus of economics, biology and thermodynamics. The Silver Gun Hypothesis is potentially very important because it offers an explanation for ‘why’ the existing economy is taking us towards 3.2°C (2.0-4.9°C at 90%) of global warming by 2100 (Raftery et al., 2018), and ‘why’ humanity currently has insufficient agency to remain below the presumed threshold for a safe climate (i.e. less than 1.5-2.0°C of global warming). The key reason appears to be that the existing economy has the emergent thermodynamic ‘skill’ of improving energy efficiency, ηw, and it lacks the thermodynamic skills needed to achieve carbon neutrality within a definite timeframe.

The crucial challenge for humanity is to discover how to build new agency to mitigate carbon emissions and to achieve net-zero carbon emissions by mid-century, or to achieve net-negative carbon emissions after mid-century. In response to the climate crisis, many thought-leaders have called for transformational change, including a fundamental and systemic change to the economy (e.g. Iwaniec, et al., 2019). But what qualifies as a suitable change? The Silver Gun Hypothesis offers this answer: ‘carrot and stick’ carbon pricing. Carrot and stick incentives are common in modern society, but its application in carbon pricing is unorthodox because it requires an extension to Arthur Pigou’s (1920) theory on market externalities, as described in the workig paper for Part II.

The Silver Gun Hypothesisis makes the claim that symmetric carbon pricing (i.e. carrots and sticks) is justified by the laws of thermodynamics. This justification involves a non-standard thermodynamic concept termed the ‘entropy of carbon in the environment’ (Sc) (refer Section II.4 of Part II). The concept of entropy is fundamental to our understanding of climate change and biology, but entropy as a concept is difficut to integrate into classical/neoclassical economic schools of thought. The Silver Gun Hypothesis brings entropy into the spotlight by proposing a philosophy of ‘economic compatibilism’, which is defined as the promotion of symmetric carbon pricing as the bridge that can formally connect classical/neoclassical economics with the natural sciences.

The Silver Gun Hypothesis appears plausible because it is verified in terms of its ability to resolve economic paradoxes (refer Section II.6 of Part II), and because its is validated against living organisms (refer Figure S2-4 above). If the hypothesis is shown to be reliable through experimental testing, then the hypothesis could provide a new pillar in the study of non-equilibrium thermodynamics, economics, evolutionary biology, paleoclimatology, and astrobiology.

If the Silver Gun Hypothesis is correct, then why do classical/neoclassical economic theories and policies fail to resolve the climate crisis? The underlying problem appears to be the classical assumption that human biology should be ignored because only human behaviour is important to our understanding of the economy. This assumption forms the classical conceptual model of the economy. This classical model offers no opportunity to connect human behavior to energy flows and entropy changes. It appears that this separation of human behaviour from human biology is the root cause of the previously mentioned economic paradoxes and the false dichotomy shown as A in Figure S2-5.

The false dichotomy (see A in in Figure S2-5) is the idea that society should rely on carbon taxes to achieve one of two possible objectives: (1) market efficiency, or (2) climate safety. It is noted here that these two objectives have different dimensions, because the former is a performance metric (e.g. work done per unit of energy), whereas the later is a probability (e.g. the chance of remaining below 2°C of global warming by 2100). Orthodox economists do not consider these dimensional differences as having tangible consequences.

The Silver Gun Hypothesis is the interpretation that the false dichotomy (see A in Figure S2-5) is resolved by applying a Global Carbon Reward to address the objective of a safe climate (see B in Figure S2-5). By accepting that the two objectives are different, a resolution to the climate crisis is found through symmetric carbon pricing. The Silver Gun Hypothesis offers a policy breakthrough by showing that economies are thermodynamically analogous to multi-cellular life, including animals, plants and fungi (see C in Figure S2-5). This approach is consistent with the idea that ‘open systems’ dissipate energy to achieve homeostasis.

Another breakthrough of the Silver Gun Hypothesis is the idea that ‘agency’ to influence the Earth’s carbon balance can be given a thermodynamic definition. The breakthrough is that this agency is the Ψ skill of natural multi-agent systems, which is the skill of entropic risk management. This definition of agency is consistent with paleo-climatological studies that correlate evolutionary changes in plants, animals and fungi with changes in the Earth’s climate. The Silver Gun Hypothesis relates these biologically driven changes in the greenhouse effect to the specific Ψ skills of plants, animals and fungi (unicellular organisms are not examined in Part II). The hypothesis also links the Ψ skill of human beings to human economies, and this anthropogenic Ψ skill is identified as the root cause of the current rise in the Keeling Curve and global warming. It appears that a new economic Ψ skill is urgently needed if the climate is to be stabilized in a Holocene-like state (refer Set 1 in Figure S2-4).

The working paper for Part II offers a potential solution to the climate crisis by reinterpreting the market failure with a unified thermodynamic approach, and to normalize the problem of climate change by equating human economies with natural multi-agent systems, such as animals, plants and fungi (see C in Figure S2-5). If the Silver Gun Hypothesis is tested and found to be reliable, then it could support a new roadmap for meeting the 2015 Paris Climate Agreement and establishing a sustainable carbon economy.

Scientists and economists are encouraged to develop experimental tests for the Silver Gun Hypothesis.

Key References

Chen, D.B., van der Beek, J. and Cloud, J., 2017. Climate mitigation policy as a system solution: addressing the risk cost of carbon. Journal of Sustainable Finance & Investment, 7 (3): 1-42.

https://www.tandfonline.com/doi/abs/10.1080/20430795.2017.1314814

Chen, D. B. (2018). Central Banks and Blockchains: The Case for Managing Climate Risk with a Positive Carbon Price. In: Transforming climate finance and green investment with blockchains. Elsevier. A. Marke, Ed., Chapter 15.

https://www.sciencedirect.com/science/article/pii/B978012814447300015X

Chen D.B., van der Beek J., Cloud J. (2019) Hypothesis for a Risk Cost of Carbon: Revising the Externalities and Ethics of Climate Change. In: Doukas H., Flamos A., Lieu J. (eds) Understanding Risks and Uncertainties in Energy and Climate Policy. Springer, Cham

https://link.springer.com/chapter/10.1007/978-3-030-03152-7_8

Chen, D. B. (2018). Utility of the Blockchain for Climate Mitigation. The Journal of British Blockchain Association, 1 (1): 1-9.

https://jbba.scholasticahq.com/article/3577-utility-of-the-blockchain-for-climate-mitigation

Chen, D. B. (2018). The Silver Gun Hypothesis: New Model for a Sustainable Carbon Economy. https://stagingphp.com/mahb/?s=the+silver+gun+hypothesis

Garrett, T. J. (2012). No way out? The double-bind in seeking global prosperity alongside mitigated climate change. Earth System Dynamics, 3, 1–17.

Iwaniec, D.M., Cook, E.M., Barbosa, O., and Grimm, N.B. (2019). The Framing of Urban Sustainability Transformations. Sustainability, 2019, 11, 573.

Pigou, A. C. (1920). The Economics of Welfare. London: Macmillan.

Raftery, A. E., Zimmer, A., Frierson, D. M., Startz, R., & Liu, P. (2017). Less than 2 C warming by 2100 unlikely. Nature Climate Change, 7, 637–641.

UNFCCC (2015). Adoption of the Paris Agreement, 21st Conference of the Parties, Paris: United Nations. Report No. FCCC/CP/2015/L.9/Rev.1

http://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf

Zappalà, G. (2018). Central Banks’ role in Responding to Climate Change: Monetary Policy and Macroprudential Regulation. Thesis. Universita’ degli studi di Padova. Dipartimento di Scienze Economiche.

About the Author

Dr. Delton B. Chen is an Australian engineer who holds a Ph.D. from the University of Queensland for his hydrogeological study of Heron Island, located in the Great Barrier Reef. Delton is a modeler/analyst in groundwater, hydrology, hot-rock energy, and greenhouse mitigation. Delton is co-founder of Global 4C and the lead developer of a policy to mitigate climate change with a Central Bank Digital Currency (CBDC).

Collaborations

A Google Group has been set-up for discussing and collaborating on the Silver Gun Hypothesis.

Jonathan Cloud (Exec. Dir.)

Delton Chen (Research)

Jim McGreen (Coordinator)

The MAHB Blog is a venture of the Millennium Alliance for Humanity and the Biosphere. Questions should be directed to joan@mahbonline.org

YouTube Resources

The views and opinions expressed through the MAHB Website are those of the contributing authors and do not necessarily reflect an official position of the MAHB. The MAHB aims to share a range of perspectives and welcomes the discussions that they prompt.